In the world of DeFi and Web3, tokenomics is often the decisive factor in a project’s success or failure. With Vesta Finance, many investors believe that VSTA tokenomics is designed to be sustainable and distinct from other projects. But is that really the case? This VSTA article will break it down in detail to give you a comprehensive view.

What is VSTA tokenomics?

VSTA tokenomics is the economic model surrounding the VSTA token, the native token of the Vesta Finance project. It defines how VSTA is issued, allocated, and used across the entire ecosystem.

A key highlight of VSTA tokenomics is its focus on sustainability and decentralization. Most tokens are allocated to the community rather than concentrated with the team or funds, helping the project avoid token dumping that can erode value.

VSTA Tokenomics

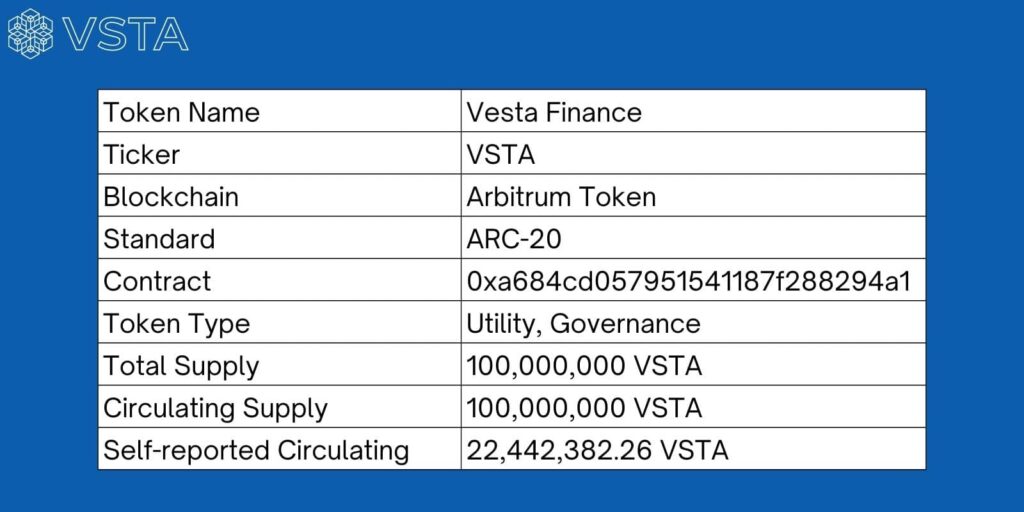

Key Metrics – VSTA

- Token Name: Vesta Finance

- Ticker: VSTA

- Blockchain: Arbitrum

- Token Standard: ARC-20

- Contract: 0xa684cd057951541187f288294a1e1c2646aa2d24

- Token Type: Utility, Governance

- Total Supply: 100,000,000 VSTA

- Circulating Supply: 100,000,000 VSTA

- Self-reported Circulating Supply: 22,442,382.26 VSTA

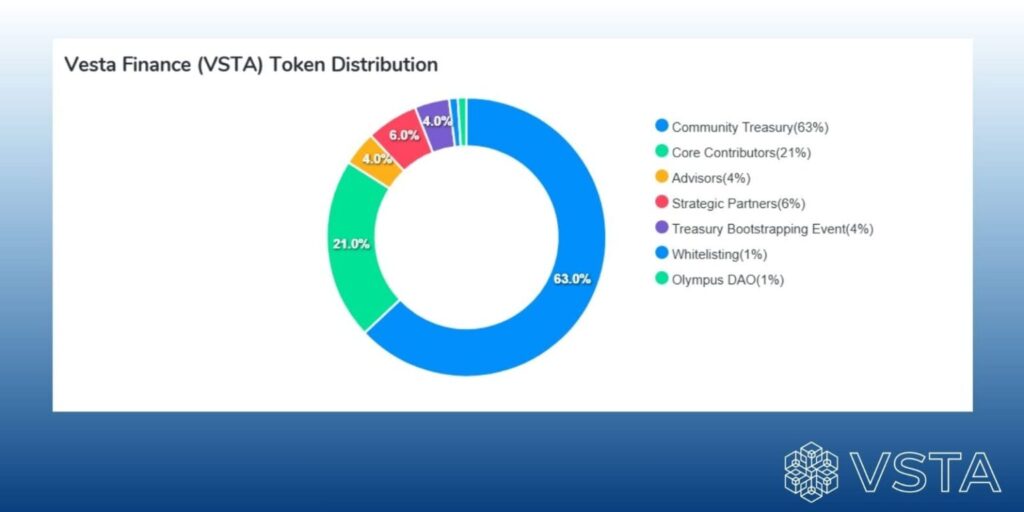

VSTA Token Allocation

The VSTA token is distributed as follows:

- Community Treasury: 63%

- Core Contributors: 21%

- Advisors: 4%

- Strategic Partners: 6%

- Treasury Bootstrapping Event (TBE): 4%

- Whitelisting: 1%

- Olympus DAO: 1%

Airdrop & Token Sale

As of September 2025, Vesta Finance (VSTA) has no recent airdrop campaigns or free token distributions. Previous sales and events include:

- Treasury Bootstrapping Event (LBP): Held on February 3-4, 2022, selling 8.12M VSTA (~4% of supply) at ~$2.85 per token, raising ~$10.08M.

- Strategic Partners Fundraise: Conducted in early 2022, allocating 6M VSTA (~6%) to strategic partners, with a 6-month cliff and 2-year vesting.

- Olympus DAO Round: Around Q1 2022, Olympus DAO acquired 6M VSTA (~6%) at ~$0.0415 per token, yielding an ROI of ~1.18x.

- Whitelist Sale: Held in Q4 2021, open to whitelisted users, allocating 2M VSTA (~2%) but only ~1% was actually issued. Tokens were sold at $0.375 each, with 50% distributed upfront and the rest vested over 2 years.

Token Release Schedule

As of September 2025, no fixed release schedule has been announced for community token allocations. Vesting details are only available for groups with clear vesting terms (advisors, contributors and partners…). The Community Treasury remains under long-term distribution with no publicly disclosed timeline.

Why is VSTA Tokenomics Considered Sustainable?

- Linked to the VST Stablecoin

Unlike many tokens that serve only speculative purposes, VSTA is directly tied to the operations of the VST stablecoin. To mint VST, users must collateralize assets such as ETH, BTC, or LSTs. This process creates real demand for VSTA, since holders benefit from fees generated across the ecosystem.

- Incentivizing Long-Term Staking

VSTA is designed to encourage long-term staking. Stakers not only earn rewards from transaction fees but also receive interest distribution. This mechanism reduces selling pressure on the market and helps keep the token stable within the ecosystem.

- 63% Allocated to the Community

More than half of the VSTA supply is allocated to the community rather than concentrated in the development team or venture capital funds. This fosters strong network effects – the more participants, the stronger the ecosystem becomes – giving investors greater incentive to stay committed long term.

- No Unlimited Inflation

The VSTA supply is fixed and cannot be “printed endlessly” like some other tokens. Additionally, mechanisms such as buybacks or token burns reduce the risk of long-term value dilution. This ensures scarcity and sustainability over time.

So, does VSTA tokenomics live up to the hype? The answer is yes – but it depends on adoption. If the VST stablecoin gains widespread usage across Layer-2 networks (Optimism, Arbitrum, zkSync…), VSTA tokenomics will prove far more sustainable and attractive compared to many other projects.

Comparing VSTA Tokenomics vs MakerDAO (MKR) and Frax (FXS)

| Criteria | VSTA | MakerDAO (MKR) | Frax (FXS) |

| Community Allocation | 63% | ~40% | ~60% |

| Supply | Fixed | Fixed | Flexible (via AMO mechanism) |

| Main Use Cases | Staking, governance, fee sharing | Governance, fee sharing | Governance, yield generation, AMO operations |

| Strengths | Community-driven, tied to stablecoin (VST) | Long-established project, high credibility | Flexible AMO mechanism |

| Weaknesses | Adoption still limited | Slow pace of innovation | Complex model, hard for users to understand |

5 Risks in VSTA Tokenomics

Dependence on VST Stablecoin Adoption: The value and sustainability of VSTA are closely tied to the adoption of the VST stablecoin. If VST is not widely accepted within the DeFi ecosystem, demand for VSTA may decline, negatively impacting its long-term value.

Volatility of the Crypto Market: Even with a sustainable tokenomics design, VSTA is still heavily affected by overall market conditions. During bear markets, staking rewards and stablecoin usage tend to decrease, causing capital outflows from the ecosystem.

Competitive Pressure: VSTA faces strong competition in the stablecoin and lending sector from major players like MakerDAO (MKR), Frax Finance (FXS), and Aave. Without maintaining a clear differentiation, VSTA risks being overshadowed by these more established and trusted projects.

Regulatory Risks: Stablecoins and DeFi remain in a legal “gray zone” in many jurisdictions. Stricter regulations could directly impact the operational model of Vesta Finance.

Technical & Smart Contract Risks: Like all DeFi projects, VSTA is not immune to smart contract risks. A security vulnerability or hack could cause significant losses for users and undermine trust in the tokenomics model.

Conclusion

Despite these risks and challenges, VSTA tokenomics still represents a significant opportunity to generate real returns. Investors need to understand the risks, craft a sound participation strategy, and optimize asset usage to succeed in the DeFi market. And remember – VSTA is here to accompany you in this “money-making game.”