The VSTA token is a familiar term for anyone participating in the Vesta Finance ecosystem. But do we truly understand its role and how to use it effectively? Let’s explore the details in today’s article on VSTA.

What is VSTA Token

The VSTA token is the native token of the Vesta Finance platform, primarily serving governance purposes. Holders can vote on system parameter changes and participate in key protocol decisions. Additionally, the token is used as a reward within the protocol and may act as a reference metric for Vesta’s operations.

Key Functions of the Vesta Finance Token:

- Governance rights: Holders of VSTA have the power to propose and vote on changes to the platform’s parameters, directly influencing how Vesta Finance operates.

- Incentives and rewards: VSTA can be distributed as rewards to users who engage with the protocol, further encouraging participation.

- Reference metrics: VSTA helps establish reference parameters within Vesta Finance, which is essential for ensuring the platform’s stability and long-term functionality.

Applications of the VSTA Token

The applications of the Vesta Finance token go far beyond its governance role within the Vesta Finance ecosystem, extending into several practical areas of DeFi. First, VSTA functions as a governance token, allowing the community to vote on and decide critical protocol changes such as collateral asset selection, system parameter adjustments, and product upgrades.

In addition, VSTA incentivizes liquidity through staking, farming, and user rewards. This strengthens both the attractiveness and stability of the ecosystem. Another important application is fee reduction, as VSTA can be used to pay or receive discounts on transaction fees within the platform.

Moreover, VSTA plays a role in risk management, serving as a layer of insurance during periods of high market volatility. Thanks to these diverse applications, the VSTA token has become a crucial link between governance, liquidity, and financial security for investors.

How to Earn and Own VSTA Tokens

There are four main ways for users to earn and own VSTA tokens:

Farming & Liquidity Mining

Users can collateralize assets such as ETH, wBTC, or gOHM on Vesta to mint the stablecoin VST. They can then use VST to participate in liquidity pools like VSTA-ETH or VST-FRAX to earn VSTA rewards. This mechanism both incentivizes liquidity in the ecosystem and provides a way for users to earn VSTA.

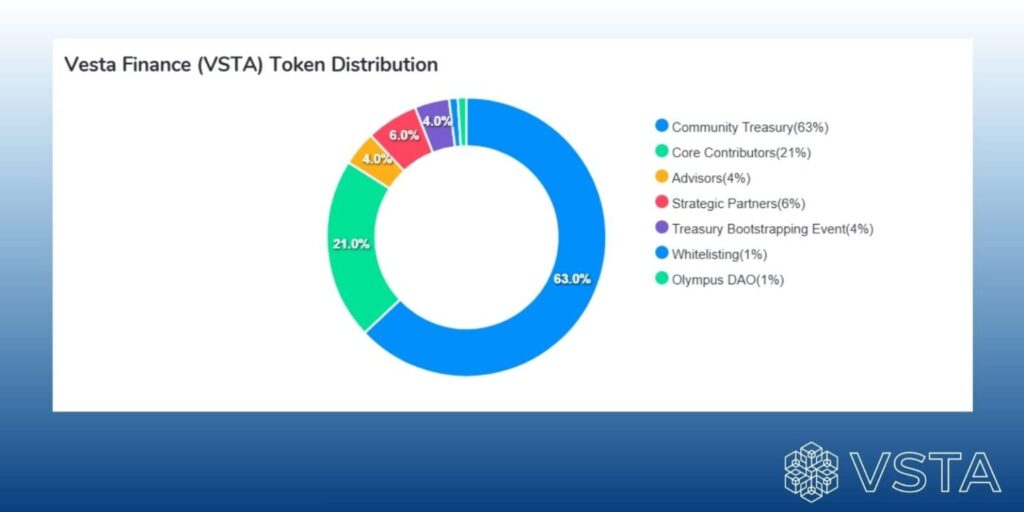

Community Fund & Project Tokenomics

According to tokenomics, Vesta allocates a significant portion of its supply – up to 63% of the total supply – to the community development fund. This encourages user participation in protocol growth and ecosystem expansion.

Grant Council / Funding Programs (~2%)

A smaller portion, around 2%, is allocated to the Grant Council. These funds are used to support community initiatives such as promotional campaigns, audits, bug bounties, and project development support. This allows users to actively contribute and be rewarded with VSTA.

Purchasing Tokens on Exchanges

For those who prefer not to engage in farming or internal programs, VSTA tokens can be purchased directly on exchanges that list it. For example, the token is currently listed and traded with a circulating supply of approximately 22.44 million VSTA out of a total supply of 100 million VSTA.

VSTA Token Wallets and Exchanges

After acquiring VSTA tokens, investors need to decide which wallet or exchange to use for storage and trading.

VSTA Token Wallets

Users can store Vesta Finance tokens in different types of wallets depending on their security and convenience needs:

- Hot Wallets: Decentralized wallets like MetaMask, Trust Wallet support storing and trading VSTA directly on Ethereum as well as Layer-2 networks (Optimism, Arbitrum). The advantage is convenience and easy connectivity with DeFi dApps.

- Cold Wallets: For long-term and secure storage, hardware wallets such as Ledger Nano S/X or Trezor reduce the risk of online hacking.

- Exchange Wallets: When trading on an exchange, VSTA can be temporarily stored in the exchange’s wallet. However, this is not a safe long-term solution — users are advised to withdraw to a personal wallet where they control the private key.

VSTA Token Exchanges

Currently, VSTA tokens are listed and traded on several centralized and decentralized exchanges:

- Centralized Exchanges (CEX): MEXC, Gate.io, CoinEx — supporting the VSTA/USDT trading pair.

- Decentralized Exchanges (DEX): Users can swap VSTA directly on Uniswap or other DEXs operating on Ethereum and Layer-2.

Note: When trading on a DEX, users need to have ETH available to cover gas fees.

Comparing VSTA Token with Liquity (LQTY) and MakerDAO (MKR)

| Criteria | VSTA (Vesta Finance) | LQTY (Liquity) | MKR (MakerDAO) |

| Launch Year | 2022 | 2021 | 2017 |

| Network | Ethereum + Layer-2 (Optimism, Arbitrum) | Ethereum | Ethereum |

| Native Stablecoin | VST (soft-pegged USD) | LUSD (100% ETH-backed) | DAI (over-collateralized USD) |

| Native Token | VSTA | LQTY | MKR |

| Total Supply | 100 million VSTA | 100 million LQTY | ≈ 1,005,577 MKR |

| Community Allocation | >50% for community, farming, and grants | Mostly distributed to early users & incentives | Low supply, allocated to DAO and early investors |

| Main Token Functions | – Governance (DAO voting)- Incentives (staking, farming, liquidity mining)- Risk management | – Rewards for staking LUSD/ETH- Protocol fee distribution- Community incentives | – Governance (risk parameters, collateral types)- Backstop role (absorbing bad debt) |

The Future of the VSTA Token

Vesta Finance is moving toward transaction optimization through smart contract efficiency and deployment on Optimism and Arbitrum. As the trend of e-commerce and crypto payments continues to expand, this creates many competitive opportunities for the VSTA token.

The success of VSTA is closely tied to the adoption of the VST stablecoin. If VST gains wider usage in both DeFi and e-commerce, demand for VSTA — as a governance, fee, and incentive token — will naturally increase. Vesta’s long-term vision is to enter practical payment use cases, not just DeFi. This represents a vast but highly challenging market.

In the future, if Vesta expands integrations with major protocols such as Curve, Aave, and Uniswap, the Vesta Finance token will directly benefit from increased utility and adoption.

Conclusion

The VSTA token was created primarily for governance while also enabling users to earn and participate in the ecosystem. This article has outlined key details about Vesta Finance’s native token. Hopefully, the insights shared above help investors and users gain a deeper understanding of the Vesta Financet oken and its long-term potential.