Let’s explore the details of VSTA price today. It is a Layer 2 lending protocol that allows investors to achieve maximum liquidity without paying any interest. Holders of the Vesta Finance token can participate in network governance. In addition, the VST token is also used to pay transaction fees, offering earning potential for its holders.

What is the VSTA token?

The Vesta Finance token (VSTA) is the governance and incentive token of the Vesta Finance platform. It plays a role in maintaining a transparent DeFi ecosystem, strengthening community engagement, and encouraging user participation.

Holders of VSTA price today have the right to participate in voting and decision-making on changes within the system. For example, adding new collateral types, adjusting collateral ratios, or updating transaction fees.

Need to know VSTA price today

VSTA price today 09/10/2025 is ₫1,283.48, with a 24-hour trading volume of ₫45.76K. Therefore, Vesta Finance (VSTA) has a market capitalization of ₫28.8 billion, achieving a market dominance of 0.00011%. VSTA price today has decreased -0.44% in the last 24 hours. Vesta Finance price details will be updated specifically below.

Key Metrics Vesta Finance

- Token Name: Vesta Finance

- Ticker: VSTA

- Blockchain: Arbitrum

- Token Standard: ARC-20

- Contract: 0xa684cd057951541187f288294a1e1c2646aa2d24

- Token Type: Utility, Governance

- Total Supply: 100,000,000 VSTA

- Circulating Supply: 100,000,000 VSTA

- Self-reported circulating supply: 22,442,382.26 VSTA

VSTA Token Allocation

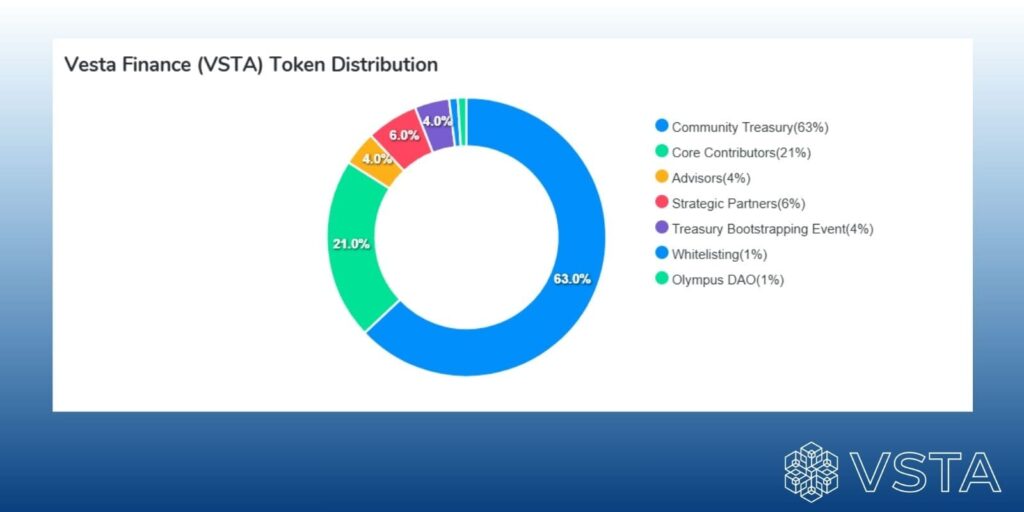

The VSTA token is distributed according to the following ratios:

- Community Treasury: Percentage 63%; a total of 63,000,000 VSTA

- Core Contributors: Percentage 21%; a total of 21,000,000 VSTA

- Advisors: Percentage 4%; a total of 4,000,000 VSTA

- Strategic Partners: Percentage 6%; a total of 6,000,000 VSTA

- Treasury Bootstrapping Event: Percentage 4%; a total of 4,000,000 VSTA

- Whitelisting: Percentage 1%; a total of 1,000,000 VSTA

- Olympus DAO: Percentage 1%; a total of 1,000,000 VSTA

Airdrop & Token Sale

As of September 2025, the Vesta Finance (VSTA) project has not announced any recent airdrop campaigns or free token distributions.

The airdrops and token sales took place during the project’s launch phase, such as:

- Treasury Bootstrapping Event (LBP): Held on February 3–4, 2022, selling 8.12 million VSTA (~4% of total supply) at around USD 2.85 per token, raising approximately USD 10.08 million.

- Strategic Partners Fundraise: Conducted in early 2022, allocating 6 million VSTA (~6%) to strategic partners; these tokens had a 6-month cliff and a 2-year vesting period.

- Olympus DAO Round: Around Q1/2022, Olympus DAO received 6 million VSTA (~6%) at a price of about USD 0.0415, with an ROI of approximately 1.18x.

- Whitelist Sale: In late 2021 (Q4/2021), a round was opened for whitelist registrants, allocating 2 million VSTA (~2%); in practice, about 1% was issued at a price of USD 0.375 per token, with 50% distributed immediately and the rest vested over 2 years.

Token Release Schedule

As of September 2025, Vesta Finance has not announced an exact release schedule for community token allocations. Specific vesting information only applies to groups with clearly defined vesting terms (advisors, contributors, partners). The community treasury is still being gradually released over the long term, with no fixed schedule officially disclosed to the market.

Token Use Cases

VSTA is the native token of Vesta Finance and is applied as follows:

- First, it can be used for governance voting if the DAO remains open, allowing holders to directly view, propose, and discuss decisions.

- Second, it is used to receive incentives from past and ongoing integration or liquidity provider (LP) reward programs.

Finally, users can use the VSTA token to track the official contract on Arbiscan to avoid counterfeit tokens.

Although in 2023 the project underwent an unwind process, which was considered relatively inactive, Vesta Finance was originally designed as a governance and incentive token for the Vesta ecosystem and therefore still holds potential for the future.

Where can you trade VSTA?

How to buy/sell VSTA

After updating VSTA price today, you can search on centralized exchanges (CEX) and decentralized exchanges (DEX) to buy or sell Vesta Finance.

On centralized exchanges (CEX): Some international exchanges list VSTA, such as Gate.io and MEXC. Users can deposit USDT/BTC/ETH and then trade directly with the VSTA/USDT pair. The main advantage of this method is stable liquidity and ease of use. However, the drawback is the requirement for KYC verification and reliance on a third party.

On decentralized exchanges (DEX): VSTA is an ERC-20 token on the Arbitrum ecosystem, and can be traded on DEXs such as Uniswap (Arbitrum), SushiSwap, or Curve (via the VST liquidity pool). Investors need a Web3 wallet (MetaMask, Rabby, etc.) and ETH on Arbitrum to pay for gas fees.

How to store VSTA

You can store VSTA coins in any wallet that supports the Arbitrum network. Trusted and widely used wallets include MetaMask, Rabby, and Trust Wallet. For convenience during trading, you can also use hardware wallets such as Ledger or Trezor for long-term storage.

Potential of the Vesta Finance Project

Development Team

Similar to many other DeFi projects, the development team does not fully disclose personal identities. However, available information indicates that Vesta Finance is not a traditional company based in a specific country, but rather a global decentralized DeFi protocol. The team has chosen to build under a DAO model, allowing the community to participate in governance through the VSTA token.

Investors in Vesta Finance

Vesta Finance has received Angel Round investments from various organizations and investors such as Tetranode, DCFGod, OmniscientAsian, PopcornKirby, Fiskantes, Not3Lau Capital, Sam Kazemian, 0xmons, Wangarian, and others.

Project Partners

The partners of Vesta Finance include Olympus DAO, Liquity, and several smaller DeFi funds that participated in its early stages.

VSTA Roadmap

The development journey of Vesta Finance is outlined through the following milestones:

- Phase 2021 – 2022

The Vesta Finance platform was established in 2021 with the goal of creating an interest-free lending protocol on Layer 2. The mainnet launch took place on February 9, 2022, enabling users to collateralize assets (ETH, renBTC, gOHM) to mint the stablecoin VST.

- Phase 2022 – 2023

Launched the Stability Pool on VST, where users could deposit VST to support liquidations and earn rewards. Introduced the Vesta Reference Rate (VRR), a dynamic interest rate mechanism to maintain VST’s peg against supply and demand fluctuations. Added new collateral assets beyond ETH, such as gOHM, GMX, DPX, and GLP, and expanded the redemption/liquidation mechanism similar to Liquity.

- Phase 2024 – Present

The project has facilitated the integration of VST into multiple DeFi ecosystems such as Curve and Uniswap to increase liquidity. It is also aiming for multi-chain expansion in the future.

Conclusion

Hopefully the information provided above has helped investors grasp the basics of VSTA price today.. Please analyze and evaluate the project thoroughly so you can allocate it appropriately within your investment portfolio. In particular, don’t forget to follow the VSTA website to stay updated with the latest news about the Vesta Reference project!