How to Earn VSTA to Increase Revenue and Wallet Profits. The answer is simple, users can earn Vesta Finance by purchasing it directly on exchanges. Alternatively, they can participate in promotional programs such as Learn2Earn and Assist 2Earn to receive free VSTA or airdrops. To help new investors easily understand how to earn VSTA, let’s explore the detailed guide below.

Why Are So Many People Interested in How to Earn VSTA (Vesta Finance)?

An increasing number of DeFi investors and users are searching for ways to earn VSTA (Vesta Finance) because it is considered one of the most promising projects within the Arbitrum ecosystem. More importantly, VSTA is not only a governance token but also opens up multiple highly profitable opportunities. Specifically:

- Opportunities from DeFi: Vesta Finance allows users to participate in decentralized financial activities such as lending and liquidity provision, where they can earn rewards in VSTA.

- Staking VSTA: Token holders can stake their VSTA to receive passive income, making it suitable for both long-term investors and newcomers.

- Airdrops & Incentives: The project frequently organizes airdrops and incentive programs to attract community participation. This allows users to acquire VSTA without investing a significant amount of capital.

Thanks to these opportunities, Vesta Finance has become an attractive destination for those looking to join the Layer 2 DeFi trend and seek sustainable income in the future.

5 How to Earn VSTA (Vesta Finance)

There are several ways for investors to earn VSTA within the Vesta Finance ecosystem. Below are some of the most common methods:

Earning VSTA through Staking

Staking VSTA is a simple method that allows token holders to generate passive income. Users lock their VSTA into a smart contract to receive periodic rewards. Those who stake consistently receive steady returns, which helps enhance both stability and security for the network.

For example, Staking Rewards recently introduced support for VSTA staking, allowing users to stake directly on the platform with benefits such as boosted APY and a clear dashboard to track yields. In addition, there are external platforms beyond Vesta Finance, such as staking aggregators, that let users maximize their rewards. However, it is important to choose a reliable validator and use non-custodial staking options to ensure safety.

How to Earn VSTA through Liquidity Mining

Participating in VSTA liquidity is another way to increase income. Users can provide assets into liquidity pools such as VST/ETH or VST/USDC on the Arbitrum network.

When joining Vesta Finance liquidity, you earn transaction fees from users swapping tokens within the pool, along with VSTA rewards as an incentive. This method is suitable for those who want to optimize their capital, but it’s important to be mindful of impermanent loss risks.

In addition, according to a Nansen analysis, Vesta Finance also features a Stability Pool, where users deposit VST to support liquidity and take on liquidation risks in exchange for VSTA rewards.

How to Earn VSTA through Governance Participation

The VSTA token is not only for trading but also serves as a governance token. Holders have the right to vote on key proposals such as product upgrades, fund allocation, or the project’s development strategies.

Some incentive programs also provide additional token rewards to active governance participants. This makes governance rights in Vesta Finance an indirect yet valuable way to earn extra benefits.

Earning VSTA through Airdrops & Incentives

For newcomers, Vesta Finance airdrops are an excellent opportunity to acquire tokens for free. The project often launches incentive campaigns such as airdrops for testnet users, early wallet interactions, rewards for trying new products, or referral bonuses. These VSTA rewards not only help expand the community but also provide investors with a chance to access tokens without initial capital.

Vesta Finance previously received ARB airdrops as part of Arbitrum’s ARB token distribution to DAOs on the network. VSTA was among the projects allocated approximately 2,704,175 ARB (worth ~$3.5 million). Project members and users could also receive additional VSTA or other tokens by participating in the DAO, staking, or holding tokens.

Buying & Holding Long-Term to Earn VSTA

Beyond the methods above, many investors choose to hold VSTA long-term as a way to profit from token value appreciation. With the rapid growth of Layer 2 and DeFi, investing in Vesta Finance could deliver significant returns if the project successfully expands its ecosystem.

Comparison of Ways to Earn VSTA (Vesta Finance)

| Method | Capital Required | Benefits | Risks | Suitable For |

| Staking VSTA | Must own VSTA to lock | Passive income, contributes to network security | Returns depend on APY and VSTA price volatility | Long-term investors, risk-averse users |

| Providing Liquidity (Liquidity Mining) | Requires VSTA + ETH/USDC for pools | Earn trading fees and VSTA rewards | Impermanent loss, high price fluctuations | Medium-capital users willing to accept risks |

| Governance Participation | Must hold VSTA to vote | Voting rights, may receive incentive rewards | Limited rewards, mostly indirect benefits | Users interested in project development |

| Airdrop & Incentives | None or very little capital | Free VSTA/ARB tokens, event-based opportunities | Unpredictable, not frequent | Newcomers, early community participants |

| Buying & Holding Long-Term | Capital required to purchase VSTA | Profit from VSTA price growth in the Layer 2 trend | Market volatility, long-term holding risks | Investors who believe in long-term potential |

Notes how to earn VSTA (Vesta Finance)

To ensure safety and efficiency when participating in ways to earn Vesta Finance, users should keep the following important points in mind:

- Verify the official token contract: Only use the VSTA contract address published on the official website or trusted platforms like CoinGecko and CoinMarketCap. This protects you from counterfeit tokens and prevents potential asset loss.

- Prepare ETH for gas fees: All transactions related to earning VSTA — such as staking, providing liquidity, or swapping on DEXs — require ETH to pay gas fees on Arbitrum. Always keep a small amount of ETH in your wallet to avoid transaction interruptions.

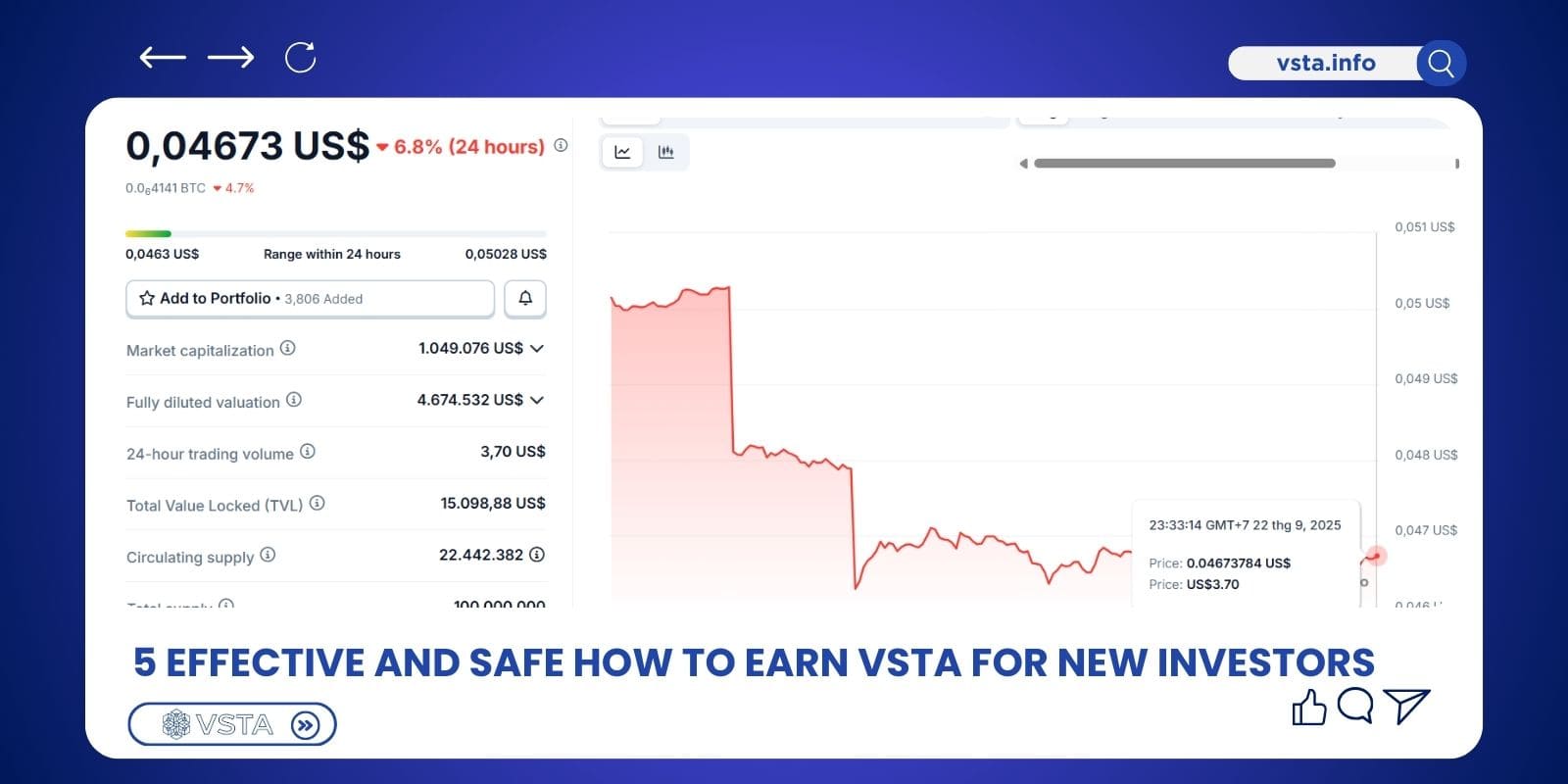

- Monitor market prices regularly: Before staking, providing liquidity, or buying & holding, check the latest Vesta Finance price on CoinGecko or CoinMarketCap. Monitoring prices helps you optimize entry timing and manage risks from market volatility.

FAQs

What is the simplest how to earn VSTA (Vesta Finance)?

The easiest methods for beginners are staking VSTA or joining Vesta Finance airdrops.

Can I earn VSTA for free?

Yes. Some airdrop and incentive programs from the project or the Arbitrum ecosystem allow users to receive VSTA without initial capital. However, these campaigns are not frequent.

Is staking VSTA safe?

Staking on Vesta Finance’s official smart contract or trusted platforms like Staking Rewards is generally considered safe. Still, users should always verify the official token contract and prepare ETH for gas fees.

Should I buy & hold VSTA long-term?

Long-term holding is suitable for those who believe in the growth potential of the Arbitrum ecosystem and Vesta Finance.

Conclusion

With the 5 methods on how to earn VSTA (Vesta Finance) mentioned above, users can choose the approach that best aligns with their investment goals.. In addition to these methods, we’ve also provided a comparison of each option. Be sure to review carefully, and if you need further investment guidance, feel free to contact us anytime. For more updates and in-depth information, don’t forget to follow this website VSTA.