Arbitrage Trading is emerging as one of the safest and most effective investment strategies. Instead of betting on whether the market will rise or fall, arbitrage investors look for golden opportunities when the same asset is priced differently across exchanges and profit from that very imbalance. Check out the detailed article below from VSTA.Info to learn more!

What Is Arbitrage Trading?

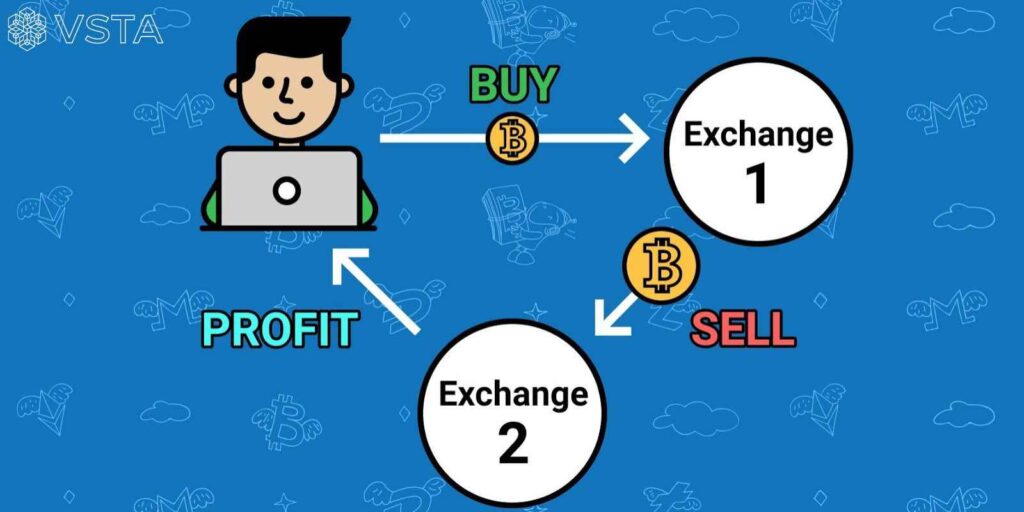

Arbitrage Trading, also known as price difference trading, is a smart investment strategy in which a trader buys an asset where it’s cheaper and simultaneously sells it where it’s more expensive, earning a nearly “risk-free” profit from the price difference.

This concept isn’t new it has been used for decades in stocks, commodities, and forex. However, the crypto market has introduced a more modern and flexible version of arbitrage, thanks to its decentralized nature and liquidity variations across exchanges.

Example:

Suppose the VSTA token is listed on two different exchanges:

- DEX A (Uniswap): 1 VSTA = 0.98 USDT

- CEX B (Gate.io): 1 VSTA = 1.02 USDT

An arbitrage trader can:

- Buy VSTA on Uniswap at the lower price (0.98 USDT).

- Transfer the token to Gate.io (or via a fast bridge).

- Sell VSTA on Gate.io at the higher price (1.02 USDT).

That’s a price difference of 0.04 USDT per token, equivalent to a 4% profit before fees.

If the trader executes this with 5,000 VSTA, the potential profit would be 200 USDT, all within a single cycle, without needing to predict market direction.

Requirements and Types of Arbitrage Trading

In the field of investment and financial trading, Arbitrage Trading has certain participation requirements and is classified into different types as follows:

Participation Requirements

For arbitrage opportunities to exist and generate actual profits, the following conditions must be met:

- Price differences must exist between markets, exchanges, or asset pairs.

- The asset must be tradable on multiple platforms (for example, a token listed on both a DEX and a CEX).

- Trades must be executed almost simultaneously to prevent price fluctuations from erasing the spread.

- Transaction costs (fees, gas, or slippage) must be lower than the expected profit, ensuring a positive net return.

Types of Arbitrage Trading

In financial markets, arbitrage trading is generally divided into two categories:

Two-Point Arbitrage: The most common form, where an investor looks for a clear price discrepancy between two markets or exchanges. For example, a currency or asset may be listed at a lower price on Exchange A and a higher price on Exchange B. The investor buys on the cheaper exchange and sells on the more expensive one, locking in immediate profit from the imbalance.

Three-Point Arbitrage (Triangular Arbitrage): A more complex strategy, often used in forex or crypto trading. Instead of relying on a direct price difference, the trader exploits inconsistencies in cross-rates among three different assets.

Example: A trader cycles BTC → ETH → USDT → BTC; if the final BTC amount exceeds the initial amount, the difference is the arbitrage profit.

Advantages and disadvantages Arbitrage Trading

Advantages of Arbitrage Trading

Generates quick profits: Arbitrage allows investors to earn from small price differences between exchanges or markets. When executed at the right moment, profits can be realized almost instantly without waiting for prices to rise or fall as in traditional trading strategies.

Lower risk compared to regular trading: Since the trader buys and sells the same asset almost simultaneously, they are less exposed to market volatility. This makes arbitrage one of the lowest-risk trading strategies, especially when supported by automation tools and real-time data.

Requires less advanced analytical skills: There’s no need for complex chart analysis or predicting market trends. Traders mainly need to understand how exchanges operate and manage transaction fees efficiently to get started.

Contributes to market liquidity: Arbitrage activity helps balance prices across exchanges. As these trades occur, discrepancies diminish, making the market more liquid, efficient and transparent.

Disadvantages of Arbitrage Trading

- Opportunities are rare and short-lived: Price discrepancies usually last only a few seconds or even milliseconds before the market self-corrects. This requires traders to monitor continuously or use automation to react in time.

- High capital and speed requirements: Because spreads are small, large institutions (funds, banks, exchanges) have an edge thanks to high-speed bots and deep capital. Without the right tools, retail traders struggle to compete.

- Actual profits can be eroded by fees: After accounting for trading fees, transfer costs, or blockchain gas fees, the small arbitrage margin can be significantly reduced or even turn negative if not calculated carefully.

Applying the Arbitrage Method in the VSTA Market

The VSTA Trading Market is not only a platform for trading the VSTA token but also a comprehensive ecosystem of data and intelligent payment tools. So how can VSTA users invest and earn profits using the arbitrage method? Let’s explore below:

Identifying Arbitrage Opportunities on the VSTA Token

Like other crypto assets, the VSTA token can be traded across multiple exchanges — such as Uniswap, PancakeSwap, or centralized exchanges (CEXs). Since each exchange has different liquidity mechanisms and order book depths, the price of VSTA often fluctuates slightly — typically by 1–3% — creating opportunities for traders to profit.

Example:

- VSTA price on Uniswap: 0.98 USDT

- VSTA price on Gate.io: 1.02 USDT

A trader can buy VSTA on Uniswap and sell it on Gate.io, capturing a 4% profit margin before fees.

Executing Arbitrage Trades on VSTA

To apply arbitrage effectively within the VSTA ecosystem, traders can follow these steps:

Step 1: Access the VSTA Dashboard

Monitor token prices across supported exchanges directly on the VSTA Dashboard to identify potential price discrepancies.

Step 2: Use the “Arbitrage Simulator” Tool

When a price gap appears, use VSTA’s Arbitrage Simulator to calculate net profit after gas fees, trading fees and slippage ensuring the trade remains profitable in real terms.

Step 3: Execute Buy–Sell Orders Simultaneously

Place simultaneous buy and sell orders through the VSTA-integrated API or trading bot, ensuring transactions occur within seconds before the market equalizes and the price difference disappears.

Combining Arbitrage with VSTA Analytical Data

Beyond manual arbitrage, VSTA Trading integrates the AI Market Scanner, a real-time market data analytics tool designed to:

- Track capital flow and liquidity across exchanges.

- Detect supply-demand imbalances, providing early signals for arbitrage opportunities.

- Issue automatic alerts when abnormal price movements occur between trading pairs such as VSTA/ETH or VSTA/USDT.

This combination of automation, analytics, and real-time monitoring empowers traders to capitalize on arbitrage opportunities faster and more efficiently.

Risks for VSTA Investors Using Arbitrage Trading

Slippage Risk: Slippage is the difference between the expected price and the actual executed price. It often occurs due to network latency, matching speed, or high market volatility.

High Competition Risk: Because arbitrage can yield nearly “sure-win” profits, competition from institutions, funds, and high-speed trading bots is inevitable. With larger capital and advanced technology, these players make it hard for individual traders to match their detection and execution speed.

Liquidity Risk: An arbitrage trade only succeeds if there is sufficient liquidity on both the buy and sell sides. In a low-liquidity market, you might buy the asset cheaply but be unable to sell immediately—or be forced to sell below your target price.

Market Volatility Risk: Arbitrage relies on temporary price stability across exchanges. During sharp market swings, price gaps can change faster than your order can execute, reversing profits or causing trades to fail.

Conclusion

We hope the insights from VSTA.Info help you understand what arbitrage is and how to profit from it on VSTA as well as with other asset classes. Wishing you successful investing and don’t forget to follow us for more useful updates!